“The trade matching will work such that the user will get the optimal combination of order book liquidity and XYK pool liquidity, depending on availability” – Dr. Makoto Takemiya

An AMM & On-Chain Order Book DEX

CEXs, including Binance, Coinbase, and Kraken, have long been the go-to platforms for crypto communities. However, the recent mishaps at FTX, Gemini, and Binance have led the crypto community to look for alternatives. The non-transparent functioning of the CEX further favors this shift. A significant trend towards DEXs is evident, with trading volumes on these platforms reflecting this growing interest.

But, can DEXs entirely replace CEXs?

DEXs face challenges such as usability, transaction speed, and overall scalability, compared to CEXs, which are often driven by their centralized servers.

The DEX industry is becoming an intensely competitive scene. In the middle of this heated competition, Polkaswap has reached a crucial point in its journey by introducing a set of features that effectively address the shortcomings of both AMMs and CEXs. This development was highlighted in a recent discussion within the SORA community.

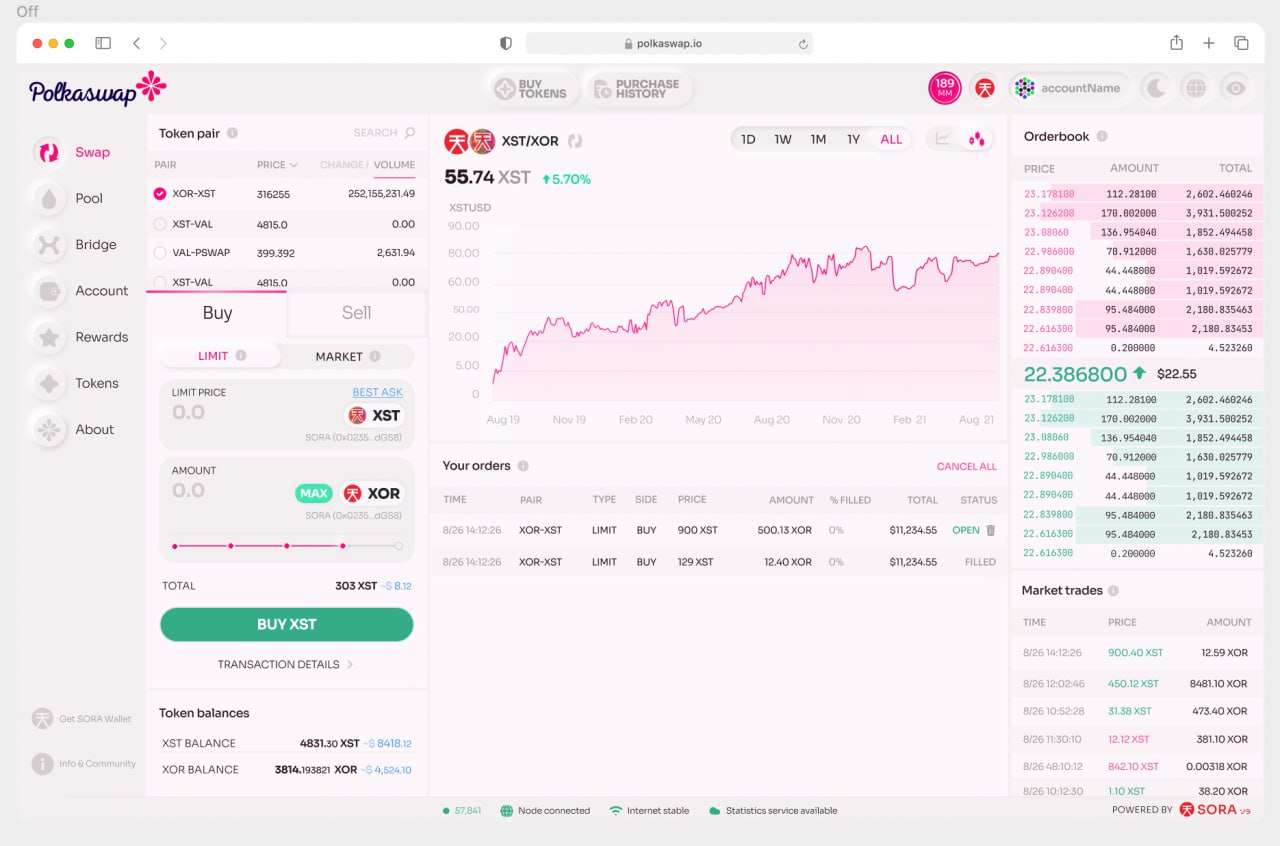

Polkaswap’s upcoming hybrid trading model in which a user’s trade is matched optimally using a combination of liquidity from two sources: the order book and the liquidity pool.

Here’s a breakdown:

Order Book: This is the system used in most CEXs. In an order book, buyers and sellers place orders at different price levels. When a buy and a sell order match in terms of price, the trade is executed. The liquidity in an order book comes from the market participants themselves, i.e., the users placing these buy and sell orders.

XYK Pool (AMM): This is the system commonly used in DEXs. The XYK model, also known as the Automated Market Maker (AMM) model, maintains a liquidity pool of two tokens (X and Y). The product of the amount of these two tokens (X*Y) is kept constant (K), which ensures that the pool can always provide liquidity for trades. This can even impact the price significantly depending on the size of the trade and the liquidity in the pool.

In Polkaswap’s hybrid model, when a user places an order, the system will intelligently match this order using a combination of liquidity from both the order book and the XYK pool. It will prioritize fulfilling the order at the best price available, depending on the liquidity available in both sources. This approach aims to provide users with the advantages of both systems: the price efficiency and depth of the order book model with the always-available liquidity of the XYK pool model.

Coming this Summer?

The hybrid order book and AMM match engine development have been in the public eye since the end of last year. Recently, SORAMITSU, a core contributor to the project, revealed significant progress in its development. Although there’s no specific timeline for its availability, optimism is high, and we’re hopeful that it may be ready by the end of this summer. Stay tuned and we will keep you updated.